What is Succession Planning and Why is it Important

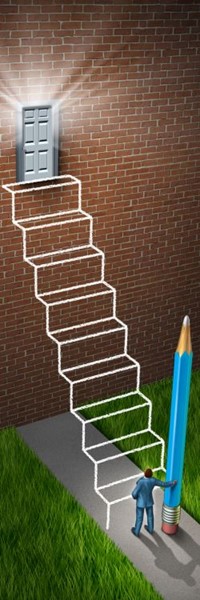

In business, much like in life, the only constant is change. As such, companies must strategically prepare for the unforeseen transitions that lie ahead. Succession planning is crucial to the ongoing success of your business, guiding the organization through the process of passing the baton from one generation of leaders to the next. Despite the importance, far too many businesses lack a comprehensive succession plan.

Marla Mundheim, lead trust and estate planning attorney at The M Firm, understands that succession planning is not a one-size-fits-all endeavor. Instead, it’s a process requiring a tailored approach that considers the unique nuances of each business. No matter the size or structure of your business, succession planning is crucial to ensure its longevity for future generations.

Understanding Succession Planning

Succession planning is more than a mere organizational strategy; it is a forward-thinking process that anticipates the future and meticulously shapes its strategy and content to align with a company’s goals and values.

At its core, succession planning involves identifying and developing individuals who can seamlessly step into key leadership roles when needed. It’s a proactive response to the inevitable changes businesses face, ensuring a smooth transition of leadership without compromising operational continuity.

Succession planning applies to more than just what happens after your death. It’s also a good idea to plan for what will happen during a divorce, disability, or when shareholders or members want to part with the company.

The Importance of Succession Planning

A comprehensive succession plan ensures your business can withstand future uncertainties that come with leadership changes. It provides stability for the organization and allows for continued growth even after you’re gone. Without proper succession planning, these critical decisions are left to the state rather than those who know best.

Ensuring Business Continuity

One of the primary reasons succession planning is indispensable is its ability to plan for uninterrupted operations. Companies mitigate the risks associated with unexpected departures, retirements, or circumstances affecting top leadership by identifying and cultivating a pool of skilled individuals capable of assuming key roles.

Mitigating Risks and Uncertainties

By anticipating and preparing for leadership changes, organizations reduce the potential for disruptions that can adversely impact productivity, employee morale, and overall business performance. It provides a safety net that allows businesses to navigate through challenges with resilience.

Navigating Buyouts and Funding Mechanisms

Some succession plans allow for a strategic buyout, ensuring a seamless transfer of control while addressing financial considerations. Successful buyout agreements are crafted with precision and foresight. This involves understanding the dynamics of the transition, valuing the business accurately, and establishing clear terms for the buyout process.

In many cases, life insurance may be used as a funding tool for buyout agreements. It provides a safety net by offering a reliable funding mechanism for buyouts. By strategically integrating life insurance into the succession plan, businesses can safeguard against financial uncertainties, ensuring that the necessary funds are readily available to facilitate a seamless transition.

Addressing Spousal Interests

Beyond the boardroom dynamics and shareholder agreements, succession planning must also consider the crucial dimension of spousal interests, particularly when non-member spouses hold community property stakes.

When a non-member spouse possesses a community property interest in a business, the complexities of succession planning multiply. Understanding the legal implications and ensuring a fair and transparent approach is paramount. This involves recognizing and addressing the challenges that arise when a business interest is part of the community property.

Spousal interests in the business can trigger intricate legal processes in the event of death or divorce. A well-crafted succession plan anticipates these scenarios, offering clarity on how surviving family members and partners should navigate such situations and protecting the business and the interests of all involved parties.

Tailoring Succession to Leadership Roles

Succession planning is not a one-size-fits-all endeavor; it requires a nuanced approach that acknowledges the diverse leadership roles within an organization. Tailoring the succession plan to the specific needs and intricacies of different leadership positions is crucial for a seamless transition that preserves the company’s vision and operational effectiveness.

Member and Partner Transitions

In businesses structured around partnerships and memberships, the transition of key individuals holds unique challenges. Succession plans must address the transfer of responsibilities, decision-making powers, and ownership stakes.

Shareholder Succession Tactics

For corporations with a shareholder-based structure, succession planning involves addressing the complexities of share transfers and maintaining corporate governance. Implementing effective shareholder succession tactics requires a careful balance between the interests of the departing and incoming leaders and the expectations of the broader shareholder base.

Legal and Financial Aspects

A comprehensive understanding of the legal and financial aspects is imperative to crafting a succession plan that adheres to regulatory frameworks and ensures the financial health and stability of the business. That’s why it’s crucial to consult with a skilled estate planning attorney to create a succession plan that will protect the future of your business.

Regulatory Compliance in Succession Planning

Succession planning is not exempt from legal considerations. Ensuring compliance with regulatory requirements is paramount to the success of any succession strategy. This involves meticulously examining local, state, and federal laws governing business transfers, tax implications, and the rights of stakeholders.

An estate planning attorney familiar with Texas laws and regulations specific to Colleyville and the Dallas-Fort Worth metroplex will be able to guide you through the process most effectively.

Financial Implications and Tax Planning

The financial implications of succession planning extend far beyond the buyout price. Understanding the tax implications associated with ownership transfers, capital gains, and other financial transactions is critical. A well-crafted succession plan incorporates strategic tax planning to optimize financial outcomes and minimize potential financial burdens on the business and its stakeholders.

Securing the Future of Your Business Through Strategic Succession Planning

For business owners in the Colleyville, TX, and Dallas-Fort Worth metroplex, strategic succession planning is a necessity for longevity and resilience. From navigating buyouts to addressing spousal interests and understanding legal intricacies, a robust succession plan is the key to seamless leadership transitions.

The M Firm can help craft a tailored succession plan, taking into account the unique needs of your business – now and in the future. Contact us today to ensure your business is fortified against uncertainties, poised for growth, and ready to navigate the future confidently. Your success and legacy are our commitment.